The Trader Who Bet It All – The Importance of Risk Management

- Categorías Inversiones

Andrés had been on a streak of successful trades. His confidence grew so much that one day he decided to bet all his capital on a single trade. “If I win, I’ll be rich,” he thought. But the market didn’t agree. In a matter of minutes, he lost the work of years. Andrés’s story is the story of many who forget the most basic rule of trading: never risk everything on a single move.

What Is Risk Management?

Risk management is the set of techniques used to limit losses and protect capital. A professional trader never risks more than a small percentage of their account on each trade—typically between 1% and 2%. This way, even after several consecutive losses, their capital remains intact to take advantage of new opportunities.

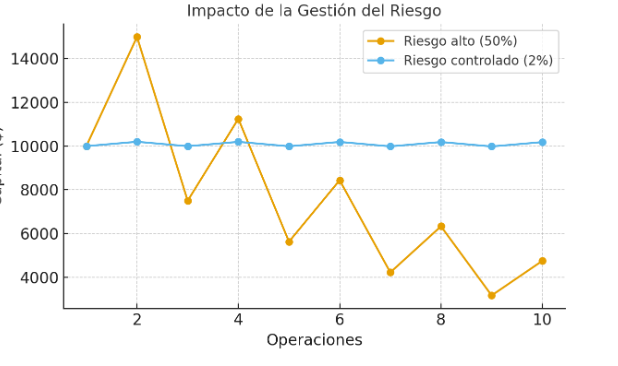

Figure 1. Comparison: a trader who risks too much (50%) can lose everything quickly, while one who risks little (2%) protects their capital in the long term

The Moral of Betting It All

In life, this mistake is reflected when someone puts all their savings into a single business without diversification, or when a person bets all their stability on one decision without a plan B. What seemed like courage ends up being recklessness.

Our Experience

Since 1997, Ismael Monte de Oca has seen this mistake repeat itself across different generations of traders. I, Marlen GonzaleZ, since 2011, have also applied the principle that the most important thing is not how much you make on a single trade, but how much of your capital you protect along the way. That’s why in our Seminar we show how to apply clear risk management rules: setting a stop loss (an exit price in case of loss), using strategies that help you average a previous position to increase the likelihood of recovery, adjusting position size, and diversifying. This is how real consistency is built in the markets.

Conclusion

The market does not forgive those who risk it all. The true professional knows that protecting capital is more important than chasing quick profits. In life, as in trading, never put all your eggs in one basket.

.