The Art of Protecting What You Love – Stop Loss and Life’s Limits

- Categorías Inversiones

Marcos was excited about his trade. The stock had risen strongly and it seemed like nothing could stop it. But soon the price began to fall. The difference between losing a little and losing everything was that Marcos had set a stop loss: an order that automatically closed his trade when it reached a predefined loss level. Thanks to that, he protected most of his capital.

What Is a Stop Loss?

A stop loss is a risk management tool. It consists of defining in advance a price level at which you will accept the loss and close the trade. This way, a bad trade won’t destroy your account. It is one of the pillars of professional discipline.

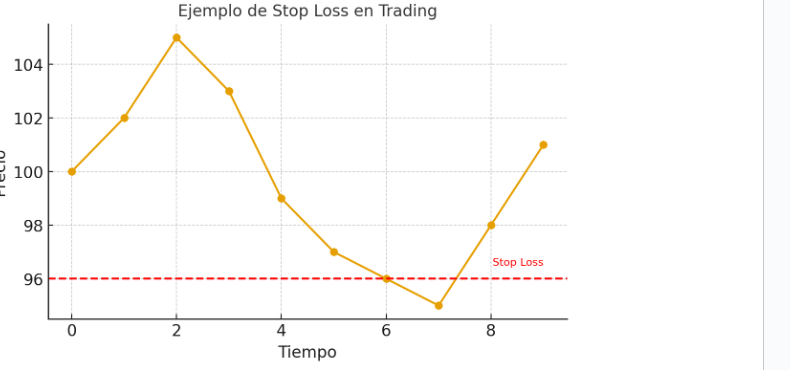

Figure 1. Example of stop loss: the trade is closed automatically once it hits the defined loss level (red line).

Real-Life Analogy

In life, we also need “stop losses.” It’s that limit we set to prevent a situation from destroying us: leaving a toxic relationship before losing our self-esteem, quitting a job that harms our health before it’s too late, or walking away from a project that consumes more than it gives. Protecting what you love means having the courage to set boundaries.

Our Experience

Ismael Monte de Oca, since 1997, has always emphasized that a stop loss is not a sign of weakness, but of intelligence. I, Marlen GonzaleZ, since 2011, have taught many students that the difference between an amateur trader and a professional is not in making more, but in losing less. In our Seminar, we show how to set proper stops based on account size and market volatility.

Conclusion

The stop loss is a reminder that we can’t control everything, but we can decide how much we are willing to lose. In life and in trading, protecting what you love means having the discipline to say “this far, and no further.” That is the first step toward growing safely and sustainably.