Automation vs. Intuition – The Balance Between Systems and Human Experience

- Categorías Inversiones

Lucía began trading with an automated system. Her software executed trades according to predefined rules: if the price broke a resistance with volume, it bought; if it fell below a support, it sold. Her results were consistent, though limited. Pedro, on the other hand, relied on his intuition. Sometimes he hit big wins, while other times he made costly mistakes. Both paths had advantages and risks.

What Is Automation in Trading?

Automation (algorithmic trading) means programming systems to execute trades according to specific rules. The trader designs the strategy, and the software executes it without emotions. This removes impulsiveness, but it can also limit flexibility when facing unexpected events.

What Is Intuition in Trading?

Intuition in trading arises from experience. A trader who has spent years looking at charts develops what’s known as “market instinct.” It’s the ability to detect patterns, recognize traps, and anticipate movements based on practice and observation. The risk is that intuition can easily be confused with impulsiveness if it’s not well trained.

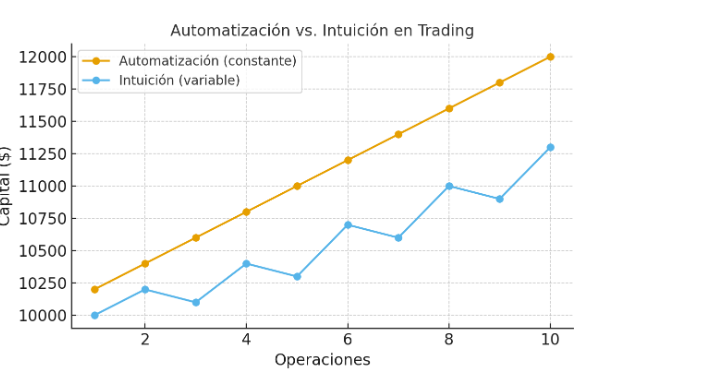

Figure 1. Comparison: automation produces more consistent results, while intuition can be more irregular but also more profitable at times.

Real-Life Analogy

In life, automation is like using autopilot on an airplane: it keeps the course steady and safe. Intuition is like the human pilot who makes decisions during an unexpected storm. Both are necessary: the system for consistency, and intuition for the unpredictable.

Our Experience

Ismael, with experience since 1997, and I, Marlen Gonzalez, since 2011, know that neither automation nor intuition is sufficient on its own. In our Seminar, we teach how to use the best of both worlds: systems that provide consistency and discipline, while at the same time developing human judgment to recognize when it’s better to step away from the rules—because that can be costly. It’s important to develop a trained eye in the market and know when it’s best to exit a trade and when it’s best to stay to maximize profits, without greed. Personally, I’ve exited positions with minimal losses, but that allowed me to recover part of my invested capital—and thanks to that, I was able to enter other opportunities that generated profits, recovering past losses and growing further. Emotionally, this plays a fundamental role in future trades!

Yes, we use machines—software and intelligent tools that help us read charts—but we also use one of the most precious things humans have: a brilliant mind that allows us to make decisions based on knowledge, applying it and trusting ourselves. And let me be clear: when I speak of automation here, I’m not talking about bots—I’m referring to applications like screeners, news tools, and others.

Conclusion

The successful trader is not the one who only trusts machines, nor the one who only trusts instinct, but the one who achieves balance. Automation provides consistency, intuition provides flexibility. Together, they form the true trading professional.