The Story of the Distracted Trader – The Danger of Information Overload in the Markets

- Categorías Inversiones

Sergio wanted to be a professional trader and thought the key was having more indicators than anyone else. He filled his screen with oscillators, moving averages, bands, stochastics, and dozens of signals. The problem was that each indicator said something different. In the end, instead of having clarity, he became more confused and lost money due to indecision. Sergio’s story reflects the mistake many make: believing that more information means better decisions.

What Are Technical Indicators?

Technical indicators are mathematical formulas applied to price and volume in order to anticipate market movements. Some examples are:

- Moving Average (MA): smooths out price to identify trends.

- Relative Strength Index (RSI): measures whether an asset is overbought or oversold.

- Moving Average Convergence Divergence (MACD): measures the strength and direction of a trend.

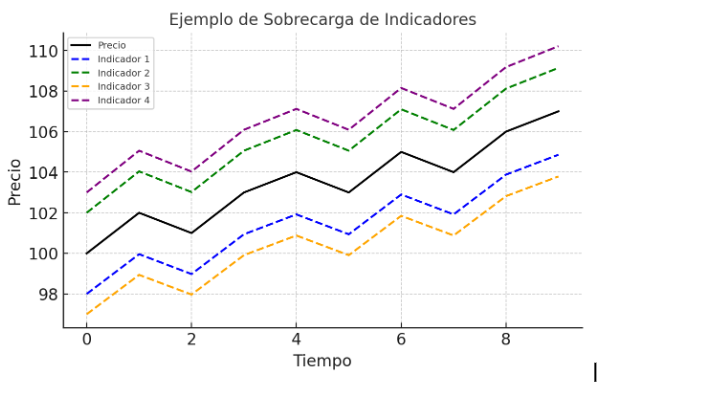

Figure 1. Example of indicator overload: too many signals on the screen create confusion instead of clarity.

Real-Life Analogy

Information overload also happens in life. When someone wants to make a decision and listens to too many opinions, they end up not knowing what to do. A student who opens ten different books to prepare for an exam may feel so overwhelmed that they learn nothing. The same thing happened to Sergio: more information led to paralysis.

Our Experience

Ismael, since 1997, and I, Marlen Gonzalez, since 2011, learned that the key is not in accumulating indicators, but in using only the necessary ones and understanding how they work. Of course, each indicator is important, but you need to know when and how to use them to avoid confusion. In our Seminar, we teach traders to simplify: to read price action first, and then complement it with a few reliable indicators that truly add value. Clarity comes from simplicity. The simpler it is, the easier it becomes to make decisions because you don’t get overwhelmed. Some indicators are better used for trends, others for short-term investments, and others for long-term strategies—without confusion, just seeing and understanding them clearly and simply.

Conclusion

The distracted trader doesn’t fail because of lack of information, but because of too much of it. Professionalism lies in knowing how to filter what really matters—in the markets and in life. At Stock Trade Pro, we train traders to see with clarity, not with screens full of noise.